About two years ago, I switched industries from political consulting to financial services. I had a somewhat notable lack of experience in finance — I’d never even bought a stock before — and so I embarked on a quest to learn as much as possible about the stock market.

The result has been about two years of non-stop reading, and I’ve learned a lot along the way. If I were doing it all over again, here’s where I’d start as a new investor:

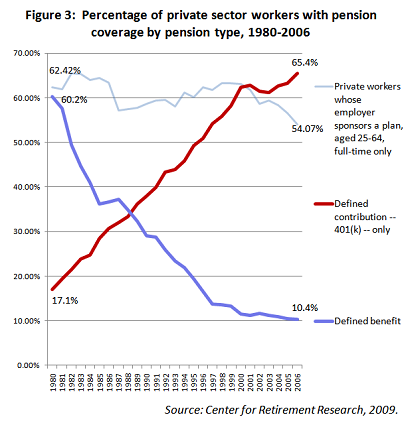

We as humans have a tendency to assume that what exists today has always existed, and to forget the evolution of the present. This holds true in finance, where most financial products are relatively recent inventions, historically-speaking. 401ks, for example, did not exist until 1978; ETFs, 1989. Even the concept of a comfortable, work-free, golf-filled retirement is relatively new. A Piece of the Action delves into this history and charts how ordinary Americans went from putting their savings in passbook savings accounts and retiring on pensions to the 401k-dominated, credit-card-filled financial lives we lead today. While it’s a bit old (1993), it’s still relevant and is a great broad, system-level introduction to financial products.

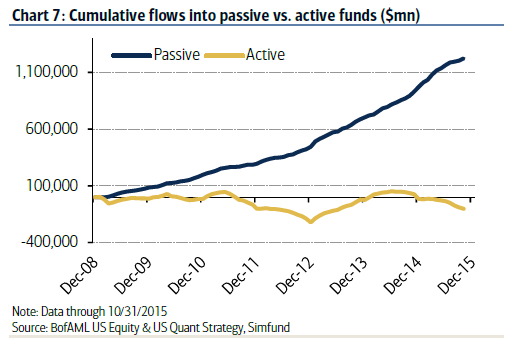

2. The House That Bogle Built: How John Bogle and Vanguard Reinvented the Mutual Fund Industry, by Lewis Braham.

Following on Nocera’s excellent deep-dive into the evolution of financial products, The House That Bogle Built is a more recent (2011) look at the driver of one of the largest trends in investing today: passive investing. While the primary focus is on Vanguard and index funds, in telling that story Braham also provides a history of mutual funds and ETFs.

3. Thinking Fast and Slow, by Daniel Kahneman.

While not explicitly related to investing, statistical thinking is one of the most valuable things I’ve learned over the past few years. Being able to understand your own cognitive biases and apply concepts like base rates and mean reversion are incredibly helpful to understanding company performance, the potential for outperformance, and the fundamental human inability to predict the future.

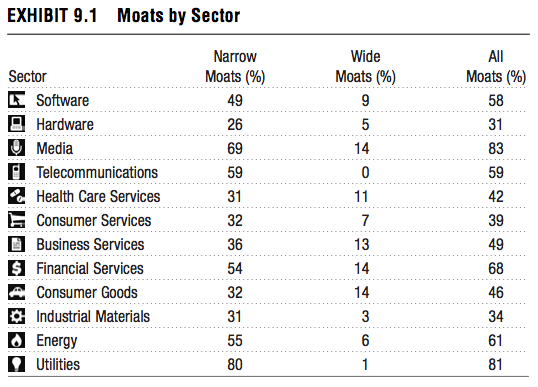

4. The Little Book That Builds Wealth, by Pat Dorsey.

Following on applying statistical thinking from Thinking Fast and Slow, Dorsey, a former head of equity research at Morningstar, makes a compelling argument that competitive advantage (moat) is a key prior that should be considered before making an investment, and that companies will eventually revert to the mean moat of their sector. This one chart alone has had a profound impact on my investing approach:

5. The One-Page Financial Plan, by Carl Richards.

Even though I work for a financial publishing company and have ample resources at my fingertips, I admit I’ve found myself googling “How to invest $X” on more than one occasion (and closed my laptop in bewilderment a few minutes later). One reason? Without a clear picture of your financial goals, it’s hard to know you’re making the right investment decisions. Thankfully, Richards, a New York Times columnist, has a solution, and presents it in a quick, enjoyable, actionable package.

6. The Little Book of Valuation, by Aswath Damodaran.

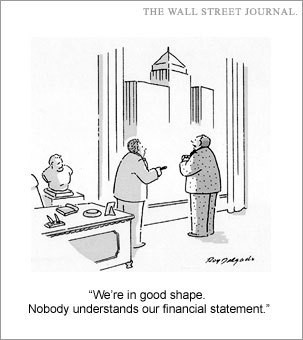

The first book I read on financial statements was Quality of Earnings: a classic, but way over my head considering I’d only casually looked at financial statements before that. The Little Book of Valuation, in contrast, is incredibly readable and actually makes analyzing financial statements and building a valuation model sound like fun. In fact, I’ve challenged myself to do a valuation for whatever company I buy shares of next. (Admittedly, I haven’t yet. But, hey, I’m busy reading, can’t you tell?)

Three others I’m glad I read (but wouldn’t start with if I were doing this again)

When I started, I surveyed my new coworkers for their favorite investing books. (It’s only recently that I’ve started to find investing books on my own.) While these were great reads, I wish I’d have nailed down some of the fundamentals before reading them.

- One Up on Wall Street, by Peter Lynch.

It’s a good introduction to investing in individual stocks and selecting your own stocks, but it made me focus on consumer discretionary companies and gave me too much confidence in my own ability to predict trends (and, similarly, in the importance of predicting trends as a long-term investing approach). I bought my first stocks after reading this book, and it led me to buying a couple of companies that in retrospect I’d never go near (looking at you, FCAU, GPRO, and ETSY). I’m glad I made those mistakes, but I wish I’d read The Little Book That Builds Wealth and Thinking Fast and Slow before this one, and especially before buying any stocks.

2. Buffett: The Making of an American Capitalist, by Roger Lowenstein.

The epic tome on Buffett, sprinkled with insights from his epic annual letters, is one not to be missed. The overall takeaway — if you have a no-growth company, re-invest the profits in something with a higher rate of return — has been a valuable business lesson for me and has had a profound impact on how I run my own business. But would I recommend a new investor spend 500 pages reading a biography? No.

3. Devil Take the Hindmost: A History of Financial Speculation, by Edward Chancellor.

I loved this book, but I also studied economics — making this book too much of “home turf” for me when the point has been learning about investing. This is rollicking economic history at its finest, though, with an important lesson: playing in the stock market with borrowed money is pretty much always a bad idea, and when everyone thinks something is a good idea, that usually means it won’t be very soon. So don’t get too excited. Don’t borrow money to buy stocks. And for the love of God, don’t buy tulips.