Note: I wrote this just before leaving The Motley Fool. I had so much fun working on product there and I’m still incredibly proud of the work we did together.

Something I’ve become excited about in the past year is increasing users’ self-esteem, especially in situations where they wouldn’t normally expect it. From retail to investing, it’s a small but high-impact way to increase user satisfaction and delight.

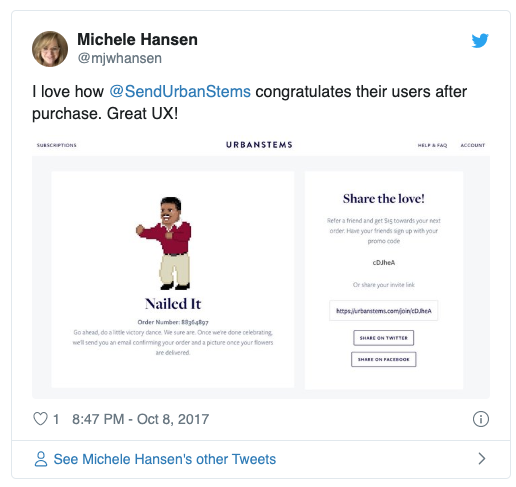

Even things we like doing — like shopping — can often feel like a slog. I encountered this myself recently. A good friend got engaged over the weekend, and I wanted to send flowers. After about half an hour of looking through various options, I ended up picking out a lovely box of succulents from Urban Stems, and was delighted when I saw this on the confirmation screen:

It was prompting me to do a victory dance! One wouldn’t normally think that someone needs to be congratulated after buying flowers. But damn! It sure felt nice, and made me that much more excited about my purchase.

At The Motley Fool, we’ve tried to bring this into the experience of researching stocks. Investing, especially investment newsletters, are not a domain generally known for emotional validation and positive re-enforcement. At their worst, there’s a lot doom-and-gloom warnings to only buy gold ETFs and over-the-top pitches for questionable penny stocks; often, at their best, relentlessly dry.

The Motley Fool, however, has always marched to its own beat, and has eschewed all of the aforementioned categories for a more fun, enriching experience. As we dug into the reasons people buy investment newsletters and research reports, we found that emotional validation was a key job that users had — especially if investing in stocks was something they did on the side as a way to do something productive and interesting with extra money.

This was especially true as it related to big trends, like mobile, AI, and geopolitics. In talking to users, we heard them say things like “I saw Watson on Jeopardy…I just knew Artificial Intelligence was going to be a big thing.” Investing was their way of participating in exciting trends, and knowing that a professional investor had looked into the trend and also thought it was likely to be big was hugely gratifying. It allowed people to think to themselves, “Hey, maybe I’ve got good sense when it comes to spotting trends.”

The next level of validation was when they saw an official recommendation for a stock they’d purchased before it had been recommended by an adviser. “When I saw you’d recommended [a stock I’d already bought], I was like, ‘Yes! This validates my thesis!” It gave them the emotional permission to think to themselves, “Hey, maybe I’m not so bad at this whole stock-picking thing.”

As much fun as discovering a new stock can be, the next step — figuring out whether and when to buy it — is just as anxiety-inducing. People want to have fun, but they also want to make sure they’re doing the right thing with their money, and it can cause a lot of internal strife. Am I buying at the right time? How much should I buy? Should I buy that other thing instead? These were questions we heard over and over again in user interviews.

We’d all previously understood the functional job of a stock research report — “show me a high quality idea that you think is likely to make money.” But those emotional jobs — validate that this is a hobby I’m good at and is worth having, and that I’m doing the right thing — hadn’t been explored as much within the structure of the product or the product experience.

After conducting this research, we realized there was an opportunity to deliver an enriching, enjoyable, intellectually-satisfying stock research experience that also incorporated these key emotional considerations. So we designed new experiences with the idea of emotional validation in mind. The combination of congratulating users plus mass personalization became incredibly interesting to us. In researching other experiences, we couldn’t find another investing experience that incorporated these elements. We instead looked to retail shopping experiences, and started studying high-end retail websites.

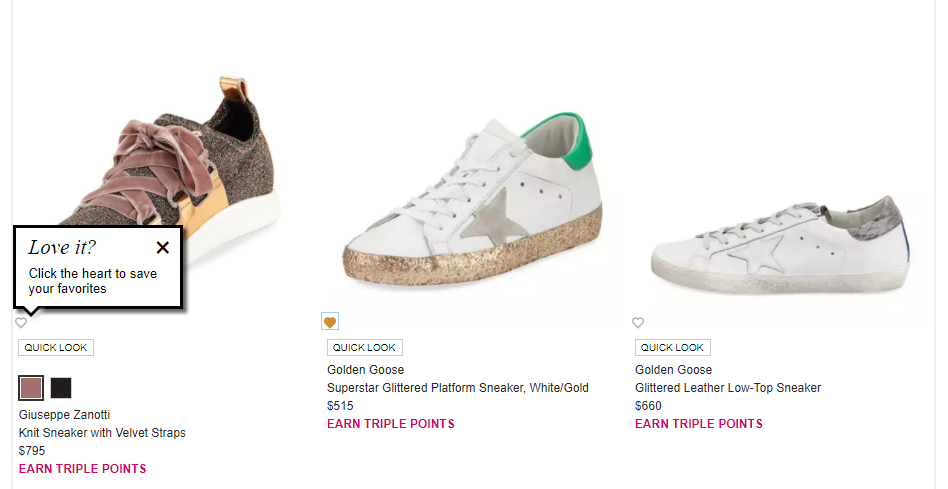

Inspired by Neiman Marcus, we brought forward the concept of hearts + the stock watchlist, as seen below.

We realized that watchlist + hearts was a small, unintrustive, yet impactful way to give users a sense of congratulation, so we put them everywhere: research reports, articles, notifications, news feeds. People loved seeing that a stock they owned was featured in a research report about an exciting new trend. They were cool without realizing it.

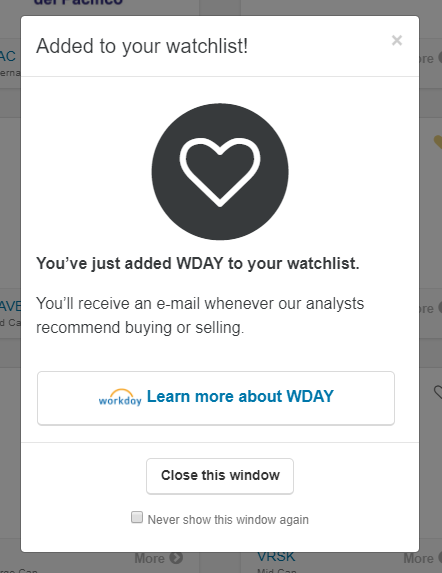

We were also drawn to the add-to-cart messages on Nordstrom’s website. Whenever you add something to your cart, the confirmation box gives you a little emotional boost and congratulates you for finding an item that’s on sale or on how nice it is. They have about a half-dozen of these messages. Two of my favorites:

We loved how these confirmation messages created a sense of affirmation and self-discovery. As part of our effort to reframe the product around the user’s interests, we wanted to embrace the idea that people loved the idea that they were discovering great stocks and had the ideas themselves (rather than the adviser being the one who found them). We played with several versions of copy on the message, ultimately landing on messaging that was less ebullient and instead focused around recognizing and alleviating their next concern— helping them figure out when to buy or sell.

This action was then pulled through into other parts of the experience (emails alerting users when the stock was a Best Buy, or, heaven forbid, a Sell), as well as guidance that helped users understand allocation and diversification.

Ultimately, I feel like we’ve only cracked open the corner on the combination of mass personalization and congratulating users in the investment space, especially as it relates to individual stock picking. Emotional validation and buoying are simple ways to surprise and delight your users, and I see a bright future for that concept in many industries beyond retail.

If you’re interested to learn more about our process and the framework that led us here, consider joining the Washington DC Jobs to Be Done Meetup.